Washington DC (US): Business Emerge Report: Wells Fargo has confirmed plans to reduce its workforce further while implementing artificial intelligence systems across operations starting in 2026, with higher separation costs anticipated during the October-December period.

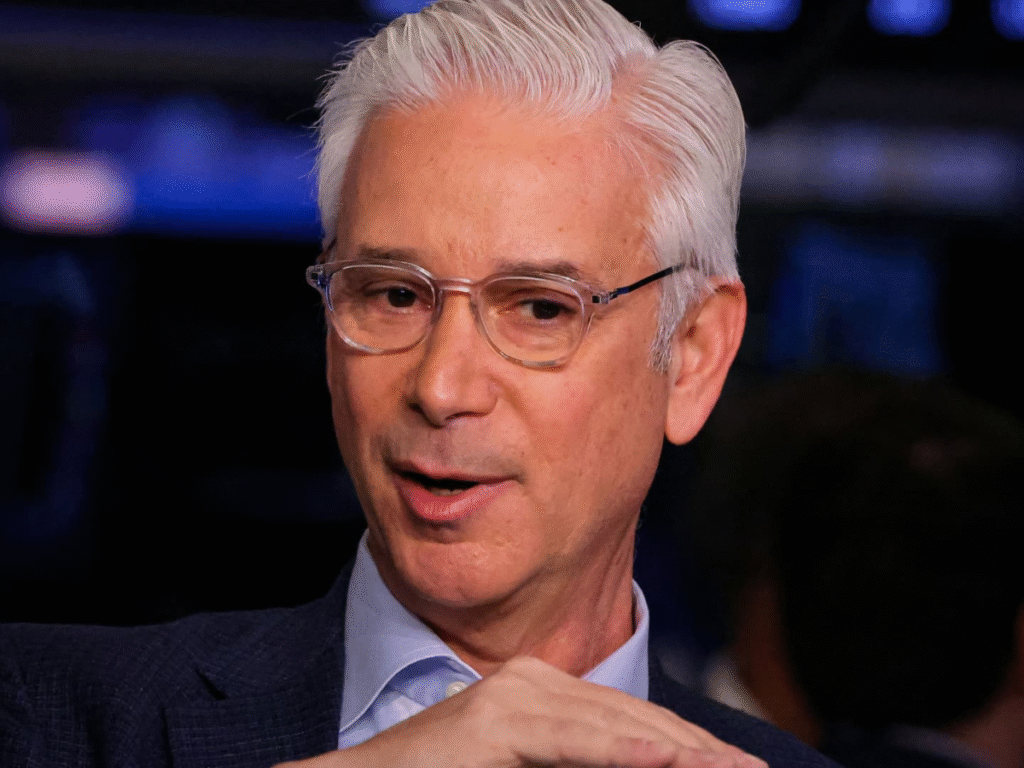

The San Francisco-based financial institution disclosed these plans during a recent financial services industry conference, where Chief Executive Charlie Scharf outlined the bank’s strategic direction for technology adoption and operational efficiency improvements.

Scharf stated that budget planning processes completed for the upcoming fiscal year indicate a smaller workforce requirement, independent of any AI-related changes. The executive noted that separation-related expenses are projected to increase during the final three months of 2025 as the institution continues restructuring efforts.

The banking giant employed approximately 210,000 workers as of September 30, 2025, representing a significant decrease from the 275,000-person workforce that existed in 2019. The reduction reflects ongoing operational streamlining measures implemented over the past six years as the institution worked to improve efficiency metrics and address regulatory requirements.

The planned technology deployment focuses on gradual implementation rather than immediate wholesale changes to existing processes. Scharf emphasized that artificial intelligence systems will modify how tasks are performed rather than completely eliminate human involvement in banking operations. Current testing within the institution’s technology development teams has demonstrated productivity improvements between 30 and 35 percent for software creation tasks, though staffing levels in those departments have remained stable while output volume has increased substantially.

The workforce adjustments come as the banking sector faces pressure to reduce operating costs while maintaining service quality and regulatory compliance. Financial institutions across the industry are exploring automation technologies to handle routine tasks, data analysis, and customer service functions that traditionally required significant human labor.

Federal regulators removed a $1.95 trillion asset restriction on Wells Fargo in June 2025, eliminating a major constraint that had limited the bank’s growth capacity since 2018. The regulatory action followed years of remediation work related to unauthorized account creation practices that resulted in substantial financial penalties and reputational damage.

Despite renewed expansion capabilities, Scharf indicated the institution maintains strict criteria for potential acquisitions, requiring clear financial benefits and strategic alignment before pursuing any transactions. The executive stated that the bank faces no urgency to complete mergers or acquisitions simply to generate modest earnings increases.

Industry analysts anticipate that workforce transformation will continue across major financial institutions as automation technologies mature and become more widely deployed. The banking sector has historically adopted new technologies to improve operational efficiency, though the pace and scope of artificial intelligence implementation remain subjects of ongoing evaluation.

The staffing reduction timeline extends through 2026 and potentially beyond as the institution assesses the impact of newly deployed systems on operational requirements. The bank has not disclosed specific reduction targets or departmental breakdowns for planned workforce changes.

Read more business news here.