SHANGHAI (Business Emerge/Asia): Hongqi has set its sights on a broader global footprint as the Chinese automotive brand works to strengthen its position in overseas markets while advancing its portfolio of new-energy vehicles. The company is preparing for a substantial rise in deliveries after several years of sustained domestic momentum.

The roadmap was detailed as executives highlighted the brand’s evolving strategy, which includes higher shipment volumes, new model launches and a wider presence across Europe, the Middle East and the Americas. The update follows a period in which Hongqi transitioned from a niche state-use manufacturer to a mass-market contender supported by its parent company, FAW.

Recent performance data reflects how sharply the brand has grown. Hongqi recorded fewer than five thousand vehicle sales in 2017. The figure rose to about four hundred twelve thousand units last year, representing growth far above the broader market average in China. The brand is working toward a target of roughly five hundred thousand vehicles this year, with management expecting a rise in demand for electric and plug-in hybrid models to contribute significantly to that goal.

Hongqi’s origins date back to the 1950s when China sought a domestically built official vehicle. The marque soon became an emblem of state mobility for senior officials before experiencing a decline as international brands gained visibility in the domestic market. Efforts to revive sales through lower-priced sedans in the following decades delivered limited results, prompting a shift in strategy focused on design modernisation and new-energy technology.

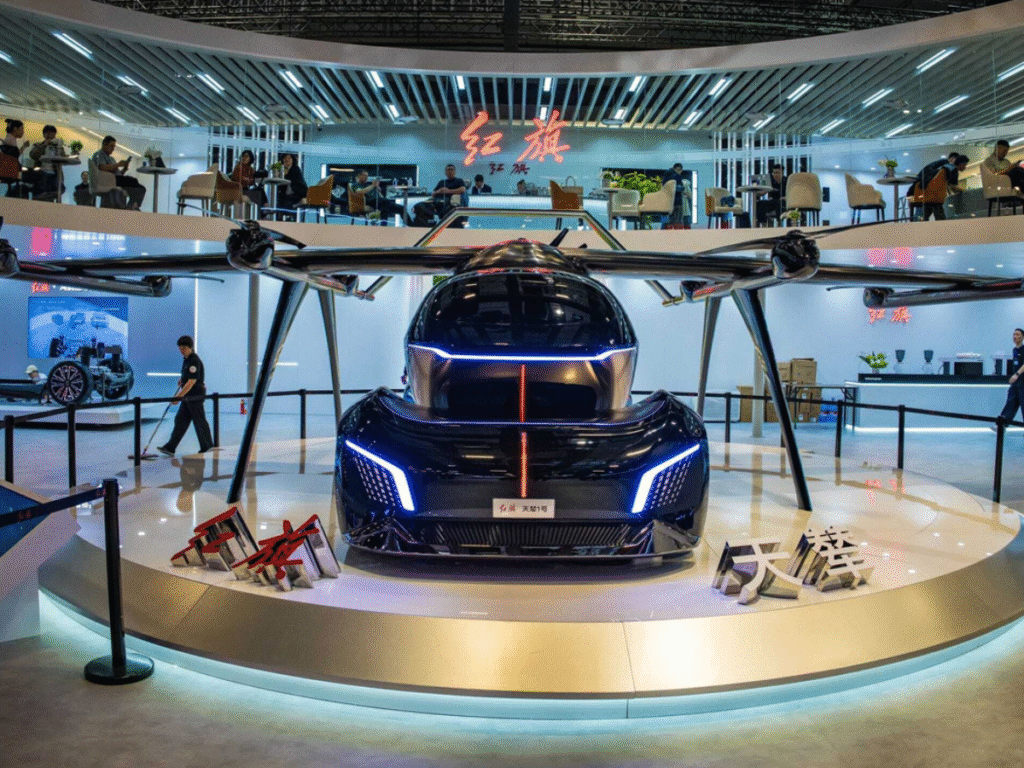

FAW initiated a comprehensive redesign initiative nearly seven years ago, led by senior design leadership recruited from global luxury brands. The refreshed product range now includes multiple SUVs and electric models, enabling Hongqi to compete across price points and meet the growing demand for battery-powered vehicles within China. The newer models have attracted a younger consumer group that values digital features and updated cabin technology.

The push for expansion comes at a time when the Chinese auto sector is navigating an extended period of intense domestic price competition. Manufacturers are increasingly turning to overseas markets to offset pressure at home. Hongqi has begun stepping up shipments accordingly. The brand transported six hundred electric sedans and SUVs to Europe in November 2024 and is working toward offering fifteen new-energy models in twenty-five European markets by 2028. The company currently has ten such models available in China.

Industry executives noted that entering regions with strong customer loyalty toward established premium manufacturers may present challenges. However, Hongqi plans to differentiate its vehicles through advanced in-car systems, including AI-enabled cockpit functions capable of voice interaction, personalised settings and curated audio recommendations. The brand expects these features to appeal to buyers seeking high-end technology at accessible pricing within the premium segment.

Hongqi has also begun introducing its models to additional global locations. Three vehicles were launched in Mexico earlier this year, marking its first entry into the Americas. Meanwhile, initial orders have been opened for the Golden Sunflower ultra-luxury line in Kuwait and other Middle Eastern countries. Consultants tracking the industry said the brand will need to build awareness from the ground up in international markets where consumers may be unfamiliar with Hongqi’s history.

Looking ahead, FAW leadership has indicated that long-term growth plans include ambitions to scale annual output to as many as one million vehicles beyond 2025, although no specific timeline has been provided. Overseas volumes are expected to contribute a rising share of that target, with the company previously stating its aim for overseas sales to account for a quarter of total deliveries by 2030.