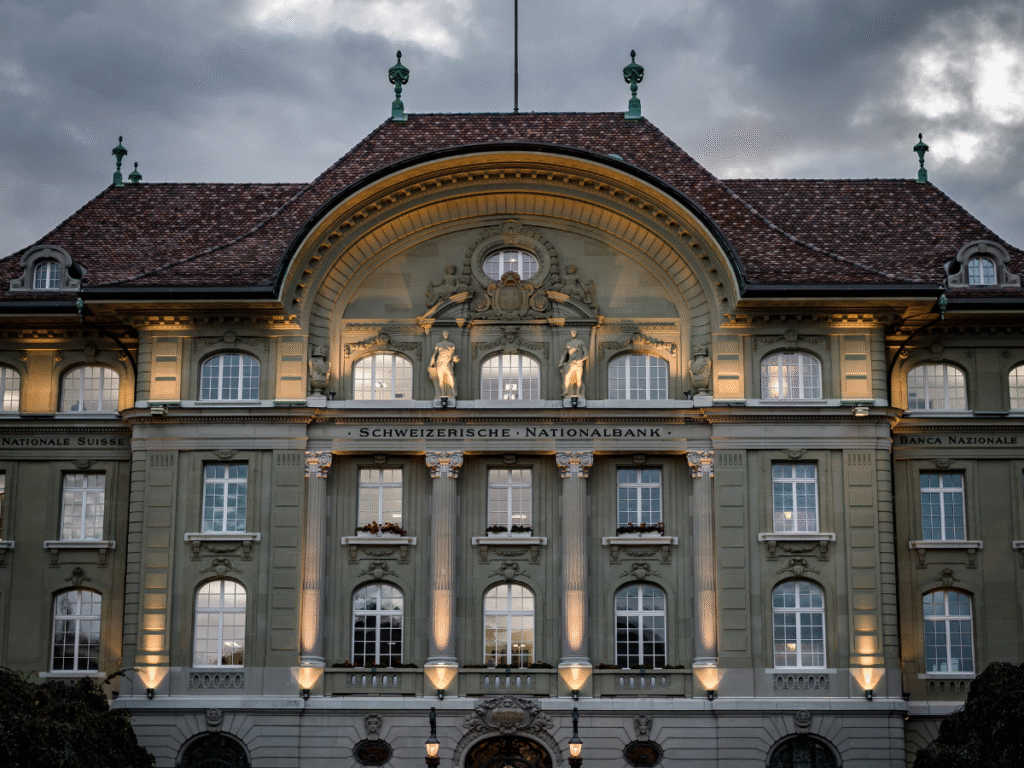

ZURICH (Business Emerge/ Europe): The Swiss National Bank said it continues to support the regulatory package designed for UBS that was outlined by the Federal Council earlier this year. The central bank stated that the framework remains aligned with Switzerland’s financial-stability objectives and should be implemented as planned.

The confirmation came during a briefing held on Thursday, where Vice Chairman Antoine Martin addressed questions on the status of the June proposals and the implications for the country’s largest financial institution. Martin noted that the central bank’s mandate requires ongoing attention to systemic-risk controls for major lenders operating in Switzerland.

Officials highlighted that the package presented in June includes capital-related requirements intended to strengthen the resilience of UBS. The proposal outlines a possible need for the bank to maintain additional capital that could reach about 24 billion dollars, reflecting the scale of risks associated with a global systemically important institution.

The measures were introduced after Switzerland reviewed the circumstances that led to the failure of Credit Suisse in 2023. Authorities began reassessing the national framework for managing large banks to reduce the likelihood of future crises and to ensure that systemically important entities can absorb severe shocks without taxpayer support.

Analysts have been monitoring the discussion around the proposed rules because of their potential influence on capital allocation, profitability planning and sector-wide regulatory expectations. Market observers say that tighter requirements for UBS could shape how other institutions prepare for long-term stability assessments.

Looking ahead, government agencies are expected to examine feedback from financial-sector stakeholders as they work toward finalising the regulatory package. Further updates could include adjustments to timelines or technical clarifications, and authorities are likely to publish the next set of implementation steps in the coming months.